Are you in the process of buying a new home? If so, you may have heard about a home buyers survey or homebuyer report. But which survey should you get, and how can it benefit you as a buyer? In this article, we will explore the definition, process, benefits, and costs associated with a house survey.

Understanding House Surveys

Definition of a House Survey

Getting a house survey is an essential step in the home-buying process that can provide valuable insights into the condition of a property. Reasons for getting one can be simply for a mortgage valuation or an appraisal of the condition of the property.

Depending on your choice it is an in-depth inspection that is conducted by a qualified surveyor before a purchase is made. The survey is designed to identify any potential issues or urgent defects that may affect the property’s value, safety, or livability.

By conducting a survey, buyers can make an informed decision about whether or not to proceed with the purchase and can be fully informed around a property value or be aware if a survey uncovers problems.

During the property survey, the surveyor will thoroughly examine the property, including its structure. They will also inspect the surrounding area to identify any potential hazards or major problems that may affect the property’s value or safety.

Once the survey is complete, the surveyor will provide a report with detailed advice outlining their findings.

Types of House Survey You Can Get

There are many types of house surveys you can get, this ranges from a free valuation survey to a full structural survey.

In England, Wales and Northern Ireland you would get a survey when you’re a buyer considering a property. You can get a survey conducted by a surveyor accredited by RICS (Royal Institution of Chartered Surveyors) these usually come in a couple of levels and have varied levels of complexity and detail they go into.

“We inspect the inside and outside of the main building and all permanent outbuildings, but we do not force or open up the fabric. We also inspect the parts of the electricity, gas/oil, water, heating and drainage services that can be seen, but we do not test them”

The excerpt above is from one of their example condition reports. So, there are some elements they do not cover.

There are other alternatives to a homebuyer report provided by other surveyors accredited by other organisations such as the ABBE (Awarding Body of the Built Environment) where you can find general home condition surveyors, specialist damp, dry rot or knotweed surveys too.

Another accredited organisation is the Residential Property Surveyors Association (RPSA) who provide a RPSA home condition survey which is very similar to a schedule of condition survey which helps assess the condition of the property.

HomeBuyers Report

(Survey Level 2)

A RICs Homebuyer Report is:

Suitable for modern, conventional properties in reasonable condition. As mentioned above it is written in a standard format set out by the RICS, providing ratings of each element of the property in a ‘traffic light’ system. Rates all permanent structures in the property, e.g. garages etc. Highlights urgent defects that could impact the property’s asking price. You might hear this referred to as a RICs home survey or homebuyer survey.

RICs Building Survey

(Survey Level 3)

A RICs Building Survey is:

Suitable for older, period properties in either poor condition or just be in a condition you might think needs further investigation. Rates all permanent structures in the property, e.g. garages etc. Highlights important problems that could affect the property’s value.

Both a RICs Condition Report and Building Survey provide an overview of the condition based on visual inspection. This is considered the most comprehensive survey from RICs.

RPSA Home Condition Survey

The condition report is a basic survey that provides an overview of the property’s condition, highlighting any significant defects or issues. This type of survey is typically recommended for newer properties that are in good condition. The report will help you to assess the property price or market value of the property.

Free Valuation Surveys That Usually Come With Your Mortgage Deal

It is important to remember these surveys do not cost anything. The report is generally for mortgage valuation purposes only and this is for when lenders offer mortgages they need to know if you do not keep up with repayments they can recover their losses but also to make survey you are not buying a property which will suddenly lose value.

Valuation Surveys That You Pay For

This house survey is similar to the above but you might get a copy of the report. It is usually lighter touch and still for the purposes of the mortgage valuation. However, if you want professional advice that is for you and not just a mortgage lender’s valuation, we would recommend looking into a homebuyer report or a fuller structural survey.

New Build Snagging Survey

This house survey is similar to a schedule of condition report but is an assessment of a new property’s condition. This type of snagging survey is a more detailed survey that produces a more detailed report that can be submitted to your builder of the property to rectify issues before the warranty expires. This home report does not deal with market valuation but does identify minor or major works required for a property including matters of ongoing maintenance. Your builder would be responsible for rectify issues.

When to Conduct a House Survey

A mortgage lender will want mortgage valuations done as part of obtaining a mortgage in principle and typically request a survey when you apply for the product. This is your opportunity to arrange your own survey for your peace of mind especially for larger or older properties.

This is after an offer has been made on a property and accepted, but before the purchase is completed.

Identifying Potential Issues

One of the primary benefits of any of the above surveys including either a homebuyer report or building survey is to identify potential issues with the property before the purchase is completed.

For example, if a mid-range survey reveals that the roof of the property needs to be replaced, the buyer can use this information to negotiate a lower purchase price or ask the seller to replace the roof before the sale is completed. This can save the buyer a significant amount of money and prevent them from facing unexpected repair costs after they have moved into the property or facing a reduced property valuation.

The Benefits of a Survey

Planning for Future Repairs and Renovations

Another benefit of getting a mid-level survey or home buyer report is that they can help buyers plan for future repairs and renovations. Depending on the type of survey a report will provide a detailed analysis of the property’s structure, including any areas that may require repairs or upgrades in the future.

Peace of Mind for Buyers

By knowing that a property has been thoroughly inspected and that potential issues have been identified, buyers can proceed with the purchase with confidence, knowing that they are making an informed decision.

Buying a home can be a stressful and overwhelming process, but a survey can help alleviate some of the uncertainty and anxiety that buyers may feel. By providing a clear picture of the property’s condition, a survey can help buyers make a confident and informed decision about their purchase.

How to find a Surveyor

Choosing a qualified surveyor is essential to ensuring that the survey is accurate and thorough. When selecting a surveyor, it is important to look for someone who is experienced and reputable.

You may want to ask for recommendations from friends or family members who have recently purchased a home or check online reviews to find a surveyor with a good reputation. In some cases, people might think a property is in reasonable condition and do not see a need for a surveyor at all.

Sometimes you can ask your opinion of your estate agent or ask them what they think of the property, bear in mind they are there to sell the property though. You could ask for a recent copy of the property energy performance certificate, this can give some indicators of whether the property needs some preventative maintenance. These small parts of due diligence can help you avoid unexpected repair costs.

Preparing for the Survey

Before the survey is conducted, it is important to ensure that the property is easily accessible and that any areas that may require inspection (such as crawl spaces or attics) are accessible. You should also make a list of any questions or concerns that you may have, so that you can discuss them with the surveyor during the inspection.

It is also a good idea to ensure that the property is clean and tidy, as this will make it easier for the surveyor to access all areas of the property. If you have pets, you may want to make arrangements for them to be out of the house during the inspection.

Understanding the Survey Report

Once the inspection is complete, the surveyor will provide a detailed report that outlines any potential issues that were identified during the inspection. The report will typically include photographs and diagrams to help illustrate these issues, and may also provide recommendations for repairs or renovations.

It is important to carefully review the survey report and discuss any concerns with your solicitor or conveyancer. They will be able to advise you on any necessary repairs or negotiations with the seller. It is also important to keep in mind that not all issues identified in the survey report will be deal breakers, and some may be easily remedied.

Costs and Timeframes for Home Buyer’s Surveys

Factors Affecting Property Survey Costs

The cost of a survey will depend on several factors, including the type of survey required, the size and complexity of the property, and the location of the property. In general, a basic condition report will be less expensive than a more comprehensive building survey.

Typical Timeframes for Survey Completion

The timeframe for completing a survey will depend on the type of survey, the availability of the surveyor and the size and complexity of the property. In general, however, most surveys can be completed within a few days to a week and can take an hour to multiple hours when at the property.

Weighing the Costs vs. Benefits

Although a house survey does come with a cost, it is important to weigh this cost against the potential benefits. In many cases, the information provided by the survey can help buyers avoid costly repairs or renovations down the line, making it a wise investment in the long run.

Conclusion

As you can see, getting a house survey can be a valuable tool for anyone in the process of buying a new property. By providing a detailed inspection of the property and identifying any potential issues, the survey can help buyers make an informed decision about whether or not to proceed with the purchase. If you are in the process of buying a home, be sure to consider the benefits.

Brightchecker Home Survey

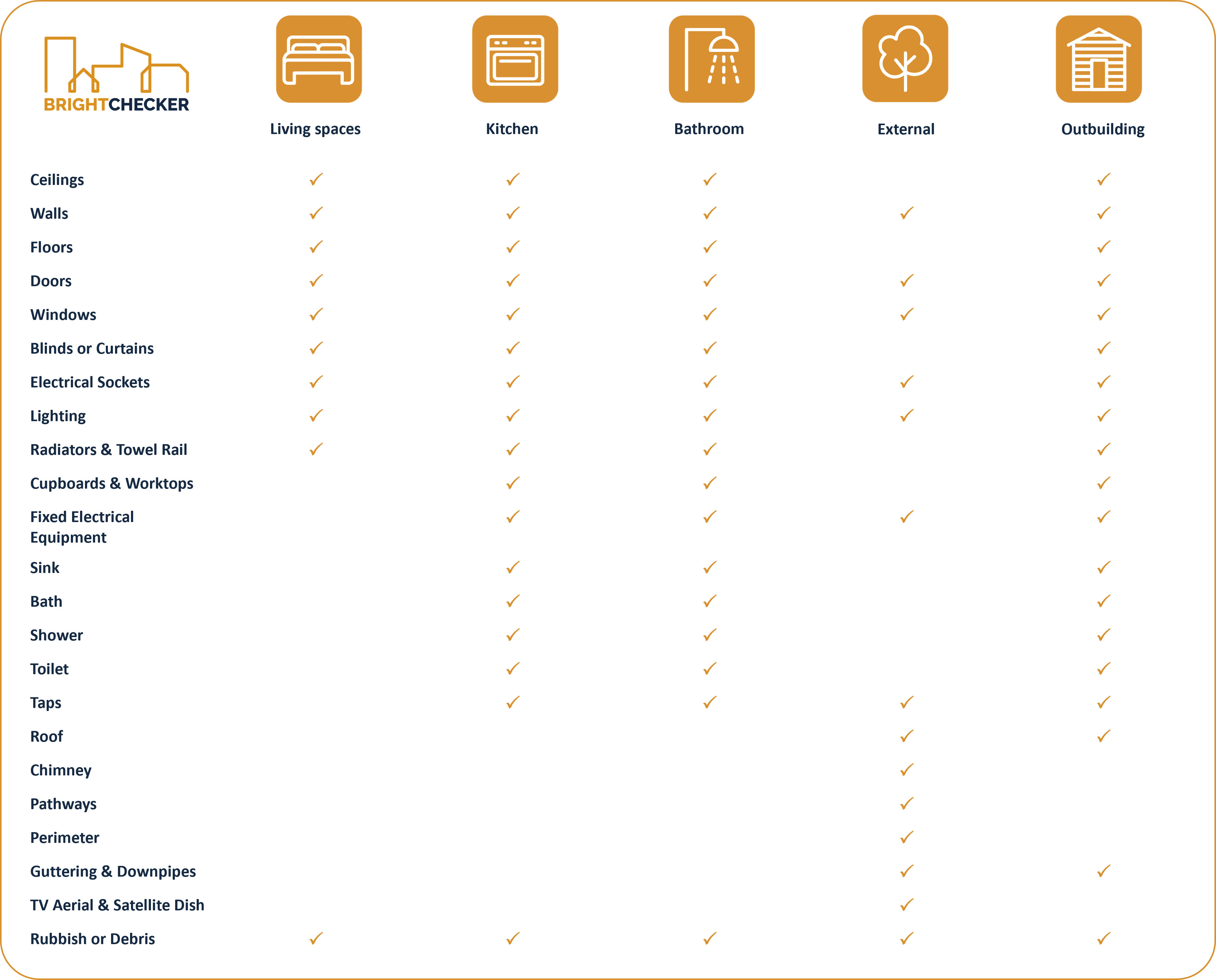

Suitable for any property new or existing build. This is more similar to a snagging survey, the check covers all fixtures within the structure of the property, e.g. lights, sockets, taps and other utilities etc. the home report will identify and highlight any issues with conventional properties that could affect your fair use of the property.

The Brightchecker Home Survey is the perfect complement to a valuation survey (for the mortgage lender), RICs Homebuyer report or another report. This home survey is not designed to diagnose structural problems. This survey costs a total of £299.99 inc. VAT. Generally, ask your estate agent if they have assessed the property fixtures, if they haven’t (and they usually don’t) it is worth considering a Brightchecker Home Report.

The Brightchecker Home Survey Checklist

See more Helpful Content

Visit our Homepage